Understanding the European renewable energy opportunity.

At Bluefield, we are fortunate to have the opportunity to speak with investors from across the world, each of which with their own preferences and experience of the renewable energy market, on a regular basis.

These interactions are vital, as they force us, as investment advisors, to confront opinions outside of our own, to question pre-conceived notions or stylistic biases, and to justify what we are doing. It is an incredibly helpful, and healthy, source of feedback.

One of the questions that has arisen frequently over the past twelve months has been regarding our European focus. This is understandable, given the rate of expansion we’re seeing across China and the US – both of which are markets we admire. However, we have focused most of our efforts on Europe as we believe it offers significant, and multi-faceted opportunities for renewable energy investors.

Policy tailwinds pushing renewables forward

Europe has, arguably, been at the forefront of the global energy transition for many years, dating back to the Paris Accords of 2015 and more recently, in 2021, when the EU made legally binding commitments to reach net zero greenhouse gas emissions by 2050.

In 2022, the energy transition gained momentum following Russia’s invasion of Ukraine. In retaliation against EU sanctions, Russia reduced gas supplies to Europe by 80 billion cubic metres, sparking an energy crisis across the continent. To quantify, in 2020, the EU had relied on Russia for 39% of its gas, 23% of oil, and 46% of coal imports, and was therefore sensitive to the subsequent price hikes and volatility.

In response, the EU introduced the ‘REPowerEU‘ plan in May 2022, aiming to end its reliance on Russian fossil fuels by 2027 by accelerating the shift to clean energy and diversifying energy sources. Progress under this plan has been swift, with Russia supplying only 15% of EU gas imports in the third quarter of 2022 compared to 23% in the second quarter and 40% in 2021. Additionally, renewable energy reached a record 44% share of electricity generation in 2023, surpassing 40% for the first time.

While 2050 remains a reference date for net zero targets, policymakers have realised that action over this coming decade is critical for these goals to be met and this creates an attractive opportunity for investors.

Maturity, technology and geography

In addition to these policy tailwinds, Europe’s diversity is perhaps what separates it from other markets as a unique investment opportunity.

The continent boasts a rich tapestry of renewable energy markets, at various stages of their respective lifecycles. This, in turn, provides investors with a broad scope of investment opportunities across both mature and emerging markets.

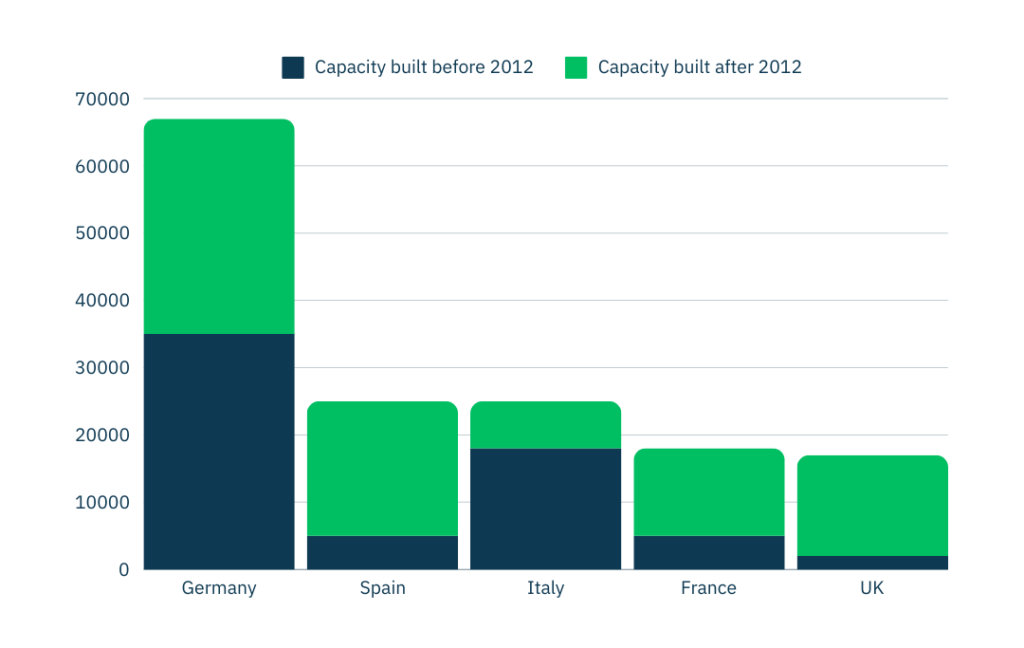

Of the former, the most mature solar markets in Europe are Germany, Spain, Italy, France and the UK, with much of the combined capacity based on assets built before 2012. As an example, in Germany, over 50% of solar capacity is over a decade old, while in Italy, a whopping 67% was built pre-2012. There is a similar trend in onshore wind, where leading markets such as Germany, Spain, Italy and Portugal are all operating on decade-old turbines.

This maturing market presents a unique opportunity for revamping and repowering – the idea of upgrading an existing asset with newer technology to enhance its output. Several of these markets have repowering policies, with notable subsidies, in place to encourage investment in modifying these legacy assets. Furthermore, revamping and repowering activities allow operators to enhance the installed capacity and production of existing assets, while taking advantage of existing land and, to the extent possible, existing infrastructure.

Europe’s ageing solar assets are ripe for repowering

There are also opportunities in markets that are earlier into their energy transition journey.

Take Poland, for example. While less advanced than countries like Italy and Spain, Poland is rapidly making progress and attracting considerable investment. One key advantage for Poland is the ability to learn from more established markets.

In the UK, wind and solar projects were typically developed separately. In contrast, Poland is developing a strategy called cable pooling, where wind and solar projects share the same grid connection. This approach facilitates a higher utilisation rate of grid infrastructure which is important given that grid availability is often the limiting factor for new developments.

Implementing cable pooling is generally easier at the beginning of the development process rather than retrofitting later, presenting opportunities for markets that are just starting out. This may also include nations such as Latvia and Lithuania, that are also making notable strides in their respective shifts towards renewable energy.

Battery storage straddles markets old and new

The thread that stretches across both opportunity sets is battery storage, something that has been recognised across the continent.

Many nations have set 2030 battery storage deployment targets, such as Spain (22GW), the UK (21GW), Germany (15GW) and Italy (14GW), among others.

The key driver for this is the intermittency of renewable energy. Solar and wind are both an intermittent source of power generation, and while their profiles are typically complementary from a seasonal perspective, a power generation system with significant solar and wind penetration is only sustainable alongside medium to long duration battery storage.

The key challenge with intermittent power generation is that there are times when the renewable power generation exceeds the demand for electricity and other times when electricity demand exceeds renewable power generation. Rather than curtailing renewable power generation at times of excess, it is clearly preferable to store the excess power generation through charging batteries and for the batteries to discharge at times when there is insufficient renewable power generation in the system.

Therefore, battery storage has become critical in stabilising the peaks and shortfalls of renewable power generation. This is particularly pertinent to the mature end of the market, where there may be opportunities for co-located batteries and hybrid plants that leverage existing infrastructure and land agreements.

At the other end of the spectrum, battery storage will be crucial to new solar and wind projects, which will otherwise struggle to become viable. These markets will benefit not only from the existing blueprint provided by Germany, Italy and other early adopters of renewable energy, but also the flexibility that comes with battery storage, which opens the door for a more entrepreneurial approach to energy management.

In conclusion

As ever, there is a tension between seeking out higher returns and managing risk. Where the European market perhaps differentiates itself from others, is in its ability to cater to both ends of the spectrum. The established markets present opportunities for revamping and repowering, whereas the more nascent end of the spectrum may produce higher returns through new build opportunities.

At Bluefield, our desire is to be diversified across technologies – solar, wind and batteries – and across the asset lifecycle, through our in-house capabilities from development, through to investment, operation, and optimisation. Europe, and all its inherent diversity, provides the opportunity to realise that ambition.

This article has been produced by Bluefield Partners LLP, authorised and regulated by the Financial Conduct Authority with firm reference number 507508.