The future of energy storage

Utility-scale battery energy storage systems (BESS) are an enabling technology with the potential to revolutionise the way we generate, store, distribute and use energy. As we transition towards a greener and more energy-efficient future, they are likely to play a pivotal role in helping reduce our dependence on fossil fuels.

BESS are becoming increasingly attractive because of their numerous energy advantages and related investment opportunities compared to conventional storage systems. For instance, unlike pumped hydro storage, batteries can be deployed in a variety of locations and are easily scaled – meaning that they are ideal for meeting high and rapid energy demand in urban or remote areas.1

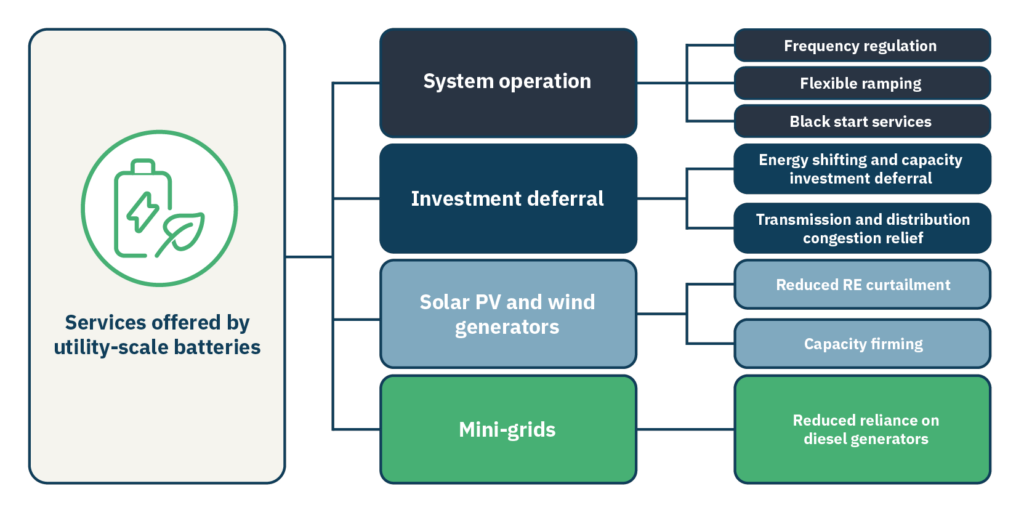

Services offered by utility-scale battery storage systems

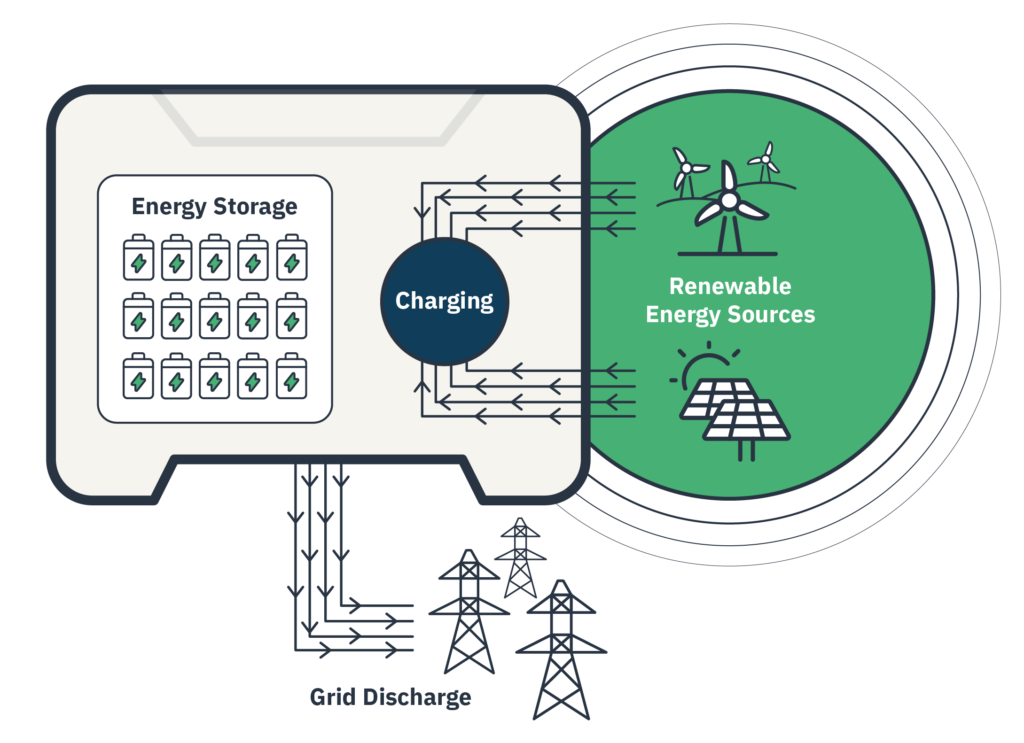

How they work

There are two primary types of BESS: in-front-of-the-meter (FTM) batteries are grid-centric, larger-scale systems strategically located to support grid stability, renewable integration, and broader grid functions. Behind-the-meter (BTM) batteries are smaller-scale and installed on-site, like homes or businesses, by end-users to provide demand-side management and reduce electricity bills.2

Opportunities abound to invest in the energy transition

Grid efficiency and reducing costs

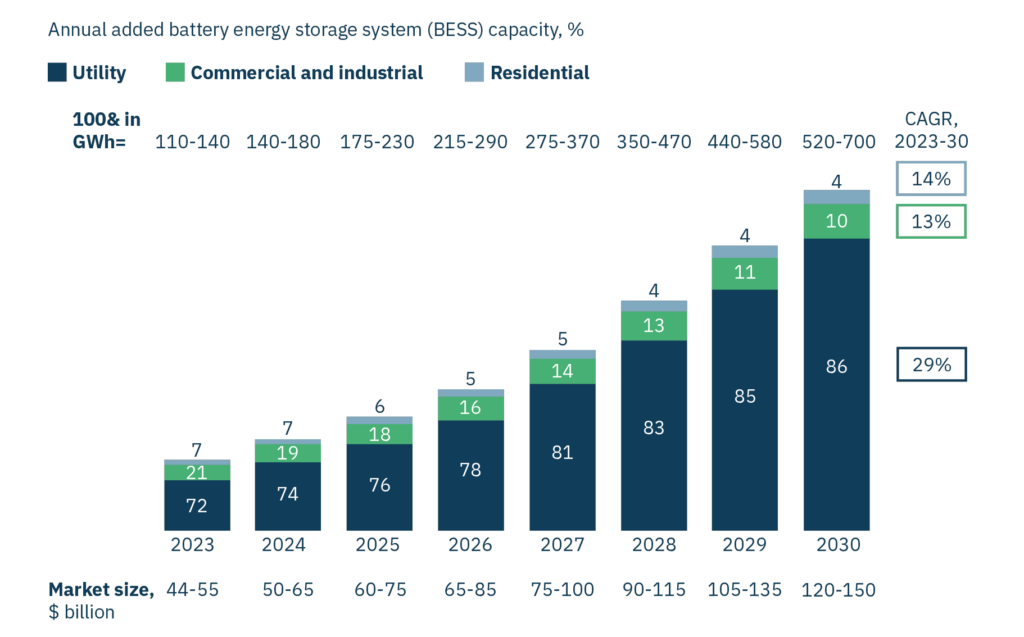

One of the most promising opportunities for batteries lies in their peak demand management capabilities. They can significantly reduce peak electricity demand, mitigating the need for costly infrastructure upgrades and enhancing overall grid efficiency. Further, their energy arbitrage capabilities are gaining momentum as battery prices continue to decline.3 As a result, BESS are projected to experience rapid growth, potentially capturing up to 90% of the total market share of by 20304, and investment will be needed to meet this demand. Forecasts predict robust annual growth across the entire lithium-ion battery supply chain, potentially reaching a market size of 4.7 terawatt-hours (TWh) and a value exceeding £320 billion by the end of this decade.5

Battery energy storage system capacity is likely to quintuple between now and 2030

Source: McKinsey Energy Storage Insights BESS market model

Grid and return stability

BESS represent an attractive investment opportunity in the rapidly evolving energy landscape. These systems play a key role in ensuring grid reliability and stability through storing surplus energy and supporting the integration of intermittent renewable sources. Therefore, as BESS can contribute to and ensure uninterrupted, low-carbon power supplies6, they have become an attractive choice for investors seeking consistent returns. This resilience, combined with their ability to offer ancillary services (the processes that enables safe, stable, and efficient power transportation around the grid)7, facilitates utility-scale batteries to meet escalating demands for grid stability whilst investors capitalise from the efficiencies achieved.8

Renewable integration

Integration between BESS and renewables is central to both their ability to shift the energy paradigm and fuel the global transition towards sustainable sources. BESS offer a lifeline not only to national grids but also isolated grids and off-grid communities because they can provide reliable and cost-effective power. The need for meeting these has intensified in recent years since the cost of living crisis has purged global economies alike. At the start of 2023, the European Parliament found that 93% of Europeans’ most pressing worry was the cost of living crisis, followed by 82% worrying about their increasing poverty and social exclusion threats.9 BESS can help alleviate these pressures by enabling reduced dependence on fossil fuels whilst also significantly enhancing energy access even in remote areas.10 This can help forge local-level economic growth and contribute to equal access to energy and communication services globally and contribute to meeting SDGs 7 and 9 (‘affordable and clean energy’, and ‘industry, innovation and infrastructure’), and indirectly SDG 4 (quality education).

BESS’s ability to store surplus energy from intermittent renewable sources means they can help address the challenge of revenue loss due to power curtailment (reduced energy utilisation to the point where surplus is lost) by helping ensure that clean energy investments yield their full potential returns 11. This revenue optimisation is driving substantial investment; more than £4 billion was invested in 2022, representing a threefold increase from the previous year.12 Looking ahead, the global BESS market is expected to expand significantly, reaching between £95 billion and £120 billion by 203013, presenting opportunities to invest in the energy transition.

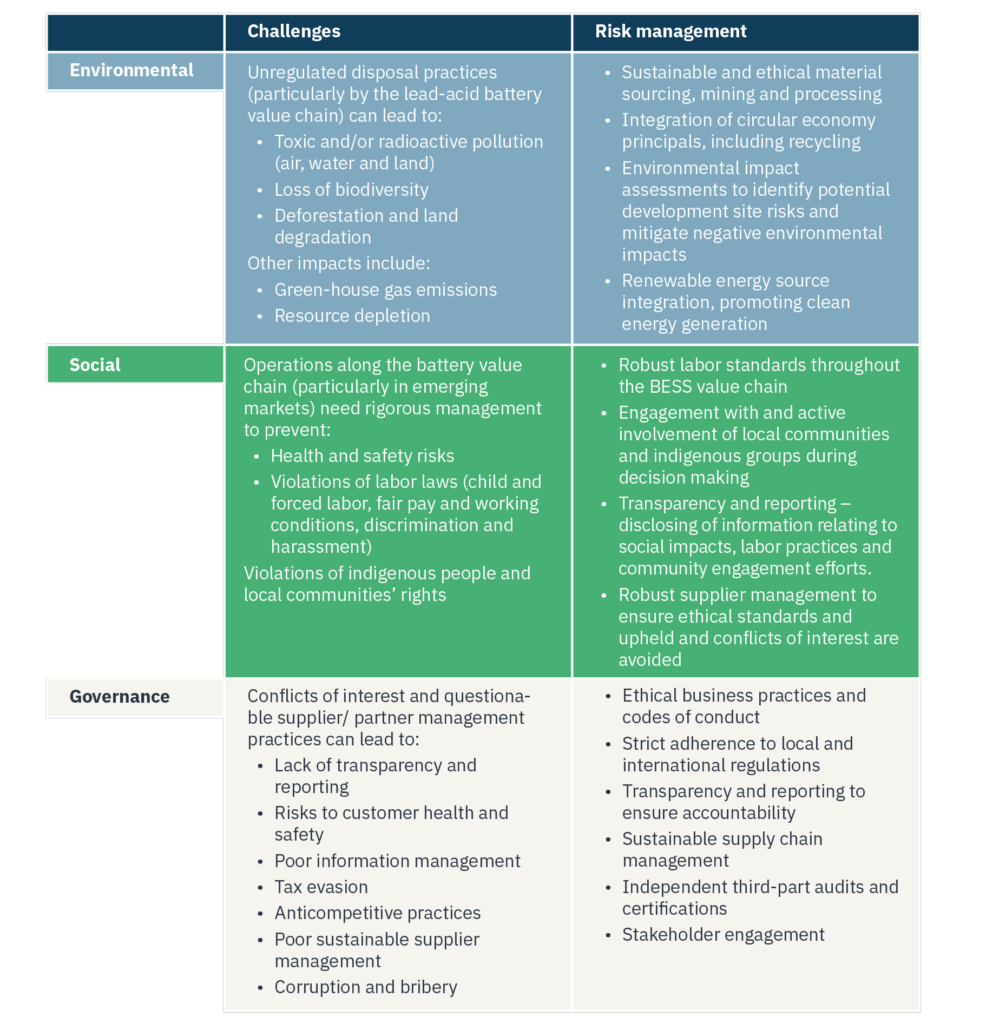

What are their challenges?

Some of the overarching challenges within the BESS market fall withing the value chain’s environmental, social, and governance (ESG) concerns. The table below outlines some of these along with the proactive measures investors and project managers can take to mitigate against them and contribute to the sustainability and responsible growth of the BESS industry.

Table 1: ESG challenges and risk mitigation measures across the BESS value chain.

Heightened focus on many of these issues and corresponding legislation and governance is likely to force improvements in many of these areas, but suppliers who are non-compliant may face taxes or fine burdens that will impact their profitability.

Regulatory considerations for BESS are heightening in the UK and EU

Regulatory concerns and requirements hold particular significance in the UK and EU’s BESS markets where governments and regulatory bodies are intensifying their focus on sustainability and the renewable energy transition.

UK

Within the UK, BESS projects are not defined distinctively from broader electricity storage systems, however they do face regulatory frameworks – notably for those exceeding 100MW. These projects are mandated to hold generation licenses which obligate them to comply with the Grid Code.14 Advancements specifically for BESS are underway with the National Grid beginning to tender for new ancillary services (enhanced frequency response ‘EFR’ contracts) which have spurred the development of standalone battery storage projects 15. Consequently, as the renewable energy market continues to grow combined with EFT contracts helping encourage improved grid stability and reliability over the long-term, they can allow investors to access predictable, reliable and steady revenue streams.

EU

The EU’s ‘Fit for 55’ program is a key pillar of the region’s commitment to achieving climate neutrality by 2050.16 Within this initiative, the BESS industry faces stringent regulations concerning sustainability, performance, and labeling. For example, carbon footprint labeling is set to become mandatory by mid-2024, while minimum recycled content rules are anticipated by the end of the decade.17

However, the EU also recognises the pivotal role which BESS can play within the region’s energy markets, as highlighted in the Electricity Market Design Directive (recast)18. In March 2023, the European Commission proposed a market reform which the aim of streamlining the integration of energy storage by reducing market entry barriers and promoting non-discriminatory procurement of balancing services; it also emphasised fair network access and transparent charging rules for market players. This regulatory framework paves the way for a more accommodating environment for utility-scale batteries within European power grids.

Conclusions

In a world increasingly focused on reducing our reliance on fossil fuels and achieving ambitious sustainability goals, BESS has emerged as a transformative solution with significant potential to facilitate the journey towards a greener and more energy-efficient future. Regulatory support for energy storage, coupled with its formal recognition in power markets, is contributing to an ever more favorable atmosphere for investment and growth in the UK and EU BESS markets. Careful and considered navigation of the risks and evolving regulatory requirements associated with BESS will be imperative to these projects’ success which will require a concerted effort from all stakeholders across their value chain to ensure their resilience and positive impact over the long-term.

DISCLAIMER

This article has been prepared and is being issued by Bluefield Partners LLP (Bluefield Partners), which is authorised and regulated in the United Kingdom by the Financial Conduct Authority (the FCA), with firm reference number 507508.

This article: (i) is for Investment Professionals (as defined in FSMA 2000) only, individuals without professional experience in matters relating to investments should not rely on this information; and (ii) is being communicated to persons who would result in such communication falling within one of the exemptions set out in the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the Financial Promotion Order).

This article is being distributed: (i) in the United Kingdom only; (ii) to Investment Professionals or a person failing within Article 49(2) of, the Financial Promotion Order (all such persons together being referred to as Relevant Persons).

Any person who is not a Relevant Person should not act or rely on this article or any of its contents. Recipients in jurisdictions outside the United Kingdom should inform themselves about and observe any applicable legal or regulatory requirements in relation to the distribution or possession of this article to or in that jurisdiction. In this respect, neither Bluefield Partners nor their respective connected persons accepts any liability to any person in relation to the distribution or possession of this article to or in any jurisdiction.

This article is for information purposes only. It is not a marketing document or any other kind of financial promotion about any fund or entity advised by Bluefield Partners and it does not constitute financial advice. By reading this article, you agree to be bound by the following limitations: (i) this article has not been verified and is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment, is intended for information purposes only and does not constitute investment advice; (ii) the information and opinions contained in this article are for background purposes only and do not purport to be full or complete; (iii) no reliance may be placed for any purpose on the information or opinions contained in this article or their accuracy or completeness; (iv) no representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this article by Bluefield Partners; and (v) no liability is accepted by Bluefield Partners for the accuracy or completeness of any such information or opinions. You should not act or rely on this article or its contents.

Recipients of this article who intend to apply for or purchase shares in any public company advised by Bluefield Partners are reminded that any such application or purchase may be made solely on the basis of the information and opinions contained in such company’s prospectus, which may be different from the information and opinions contained in this article.

Past performance is not a reliable indicator and cannot be relied upon as a guide to future performance of any investment.