Ten-years ago, I was invited to the first edition of the Solar Finance Forum, and this February I was invited to their 10th annual conference. A decade ago, I participated in a panel to discuss what steps and actions were needed to make the solar industry attractive to major financing institutions and investors. This year, we reflected and looked to the future as we considered what the next 10-years may hold for the solar industry as it continues to grow and play an increasingly important role in the energy industry.

Today, answering those questions is more challenging; it is a difficult, if not impossible, task to predict the future. But what one can do is look at the last ten years (2012-2022) to observe how the market has evolved, what the main changes were, and what the key drivers of growth have been. Identifying these factors may then help to predict a trajectory for the industry over the next 10-years.

Solar has become truly global

If we look at the installed solar capacity in 2012, these figures are astonishing – particularly when compared with today’s numbers. At that time, the global solar capacity installed was ‘only’ around 100GW, with Europe taking the lion’s share at ca. 68GW installed, almost 70%i of global capacity.

Fast forward to more recent times, at of the end of 2022, global solar capacity was ca. 1.1 TW (1,100 GW)ii – that is a 10-fold growth in 10 years. Last year alone, ca. 270GW of solar capacity were installed globallyiii (more than double of 2012’s total global capacity), of which ca. 125GW was in Chinaiv and ca. 41GW in Europev.

Notably, a significantly smaller percentage of global capacity is now in Europe. Whilst today’s European cumulative capacity is still remarkable, ca. 210GWvi, it now represents less than 20% of the newly installed capacity globally. As the solar capacity installed in the rest of the world, particularly China, has rapidly picked upvii, Europe has slowed down the pace of development.

Trend 1 – Although Europe remains a significant market with bright perspectives in terms of solar development, it is no longer the centre of gravity that it used to be 10-years ago, when Europe had ca. 70% of global installed capacityviii.

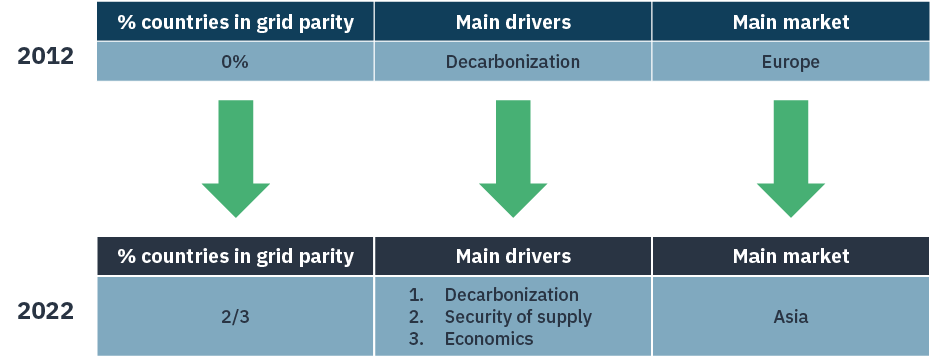

Back in 2012, favourable governmental incentives/subsidies enabled Europe to dominate the solar marketix. Incentives were introduced as solar was not at grid parity in any European country yet, a key component required to achieve one main goal: decarbonisation.

The market drivers today have evolved significantly with two new drivers coming into the picture alongside decarbonisation: security of energy supply and economics.

At Bluefield, we have long held the belief that government incentives for renewable energy are a good investment; not only because they promote decarbonisation, but also because they help increase energy security (a new solar plant is a straight reduction in the import bill for oil and gas from unreliable countries). It took the war in Ukraine for governments to realise that investment into domestic sources of electricity is crucial, reliable, and cost effective.

The other main driver is simply the economics behind solar energy production. Solar is now the cheapest form of electricity generation in many geographies, with solar reaching grid parity, a reality when electricity generated can be sold for a profit in the electricity market without any incentive or subsidy, in almost 70% of countriesx. This means that solar plants no longer require incentives/subsidies to be built. In a period of high inflation this is even more relevant and solar can become a powerful tool for governments to fight the cost-of-living crisis.

Trend 2 – Decarbonisation is now not the only driver of solar energy growth. Security of energy supply and economics also act as a catalyst to the growth of the industry.

The emergence of these two powerful drivers is very relevant and by looking at them we can try to predict the direction of travel for the solar industry over the next 10-years. I think that decarbonisation will clearly remain an important driver, but security of energy supply will play a crucial role at least over the next 4 to 5-years.

When we talk about the security of energy supply, we talk about matters of national security. Governments will be interested in keeping a close eye on the industry’s progression by making sure the deployment of solar and wind technologies are accelerated. Consequently, I expect that over the next 10-years, government invention will be a relevant factor to take into account, and one that will likely positively affect the pace of solar energy growth.

As it is already happening, government intervention may focus on facilitating development by seeking to simplify permitting procedures, clarifying guidance around the use of land for solar and wind farms, and creating favourable conditions for expedited growth. They may also reintroduce incentives or push renewables to fixed long-term PPAs aimed at fostering the development of technologies that offset the high cost of traditional electricity generation sources.

Another possible direction for government intervention may be the attempt to promote national champions – big national or regional players that may be, somehow, influenced, controlled, or connected to policy makers within government.

On the other hand, the growth of the industry may be pushed towards the ‘utility-sation’ of solar energy. For this to be achievable, utility scale facilities will become increasingly important.

Trend 3 – The ‘utility-sation’ of the solar industry – scale will matter more.

I think solar will become an ever more central component of the future’s energy infrastructure. It will, however, need to work in combination with complementary technologies such as storage, alternative sources of renewable generation, and gas plants. Therefore, I believe that we will see less stand-alone solar-only players and more large-scale solar energy producers.

My conclusions

Whilst it is difficult to predict the trajectory of the solar industry, I believe solar will continue to grow rapidly and it will increasingly play a central role in the energy transition through being the cheapest form of electricity alongside its ability to improve the security of supply and reduce carbon emissions.

i http://www.earth-policy.org/mobile/releases/solar_power_2013

ii https://www.solarpowereurope.org/news/2022-the-year-of-terawatt-solar

iii https://www.pv-magazine.com/2022/12/23/global-solar-capacity-additions-hit-268-gw-in-2022-says-bnef/#:~:text=BloombergNEF%20Analyst%20Jenny%20Chase%20says,hit%20315%20GW%20in%202023

iv https://www.pv-magazine.com/2022/12/23/global-solar-capacity-additions-hit-268-gw-in-2022-says-bnef/#:~:text=BloombergNEF%20Analyst%20Jenny%20Chase%20says,hit%20315%20GW%20in%202023

v https://www.pv-magazine.com/2022/12/19/europe-added-41-4-gw-of-new-solar-in-2022/

vi https://www.pv-magazine.com/2022/12/19/europe-added-41-4-gw-of-new-solar-in-2022/

vii https://ourworldindata.org/grapher/installed-solar-pv-capacity

viii http://www.earth-policy.org/mobile/releases/solar_power_2013

ix http://www.earth-policy.org/mobile/releases/solar_power_2013

x Bluefield DDQ, 2023