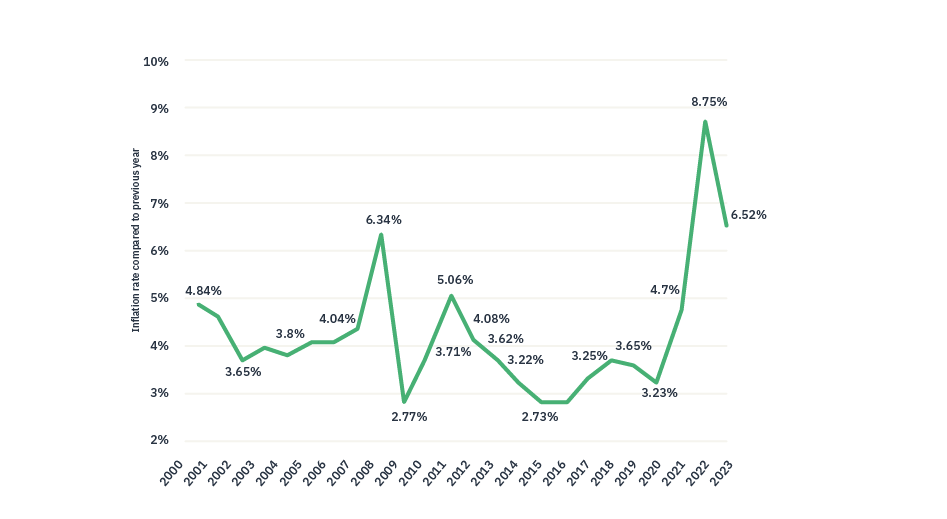

Following three decades of relative stability, global economies have witnessed inflation levels rise exponentially over the past year. While this process began during the global pandemic, it was exacerbated in February of 2022 when Vladimir Putin’s Russia launched its invasion of Ukraine.

As one of the world’s leading suppliers of oil, Russia was able to limit its delivery of the precious commodity into mainland Europe and other areas, in response to sanctions related to the war. As a result of the limited supply, energy prices soared in the interim1, with the impact of this increase rippling across the broader economy.

Since February 2022, developed economies such as the United States, United Kingdom and Europe have seen inflation reach forty-year-highs2, with their respective central banks forced into action to combat this. For example, the US Federal Reserve raised interest rates seven times over the course of 20223, while the Bank of England went a step further, with nine rate rises over the calendar year4.

While inflation’s surge began to cool somewhat near the end of 20225, there is an expectation among analysts that any drop in inflation may stop short of its previous lows, meaning that inflation, and subsequently interest rates, may remain higher, for longer.

Global inflation rate from 2000 – 2022

How might infrastructure protect against inflation?

An inflationary environment may become a headwind for an investment portfolio, despite it being diverse in both its asset class and geographical exposures. For example, 2022 was one of the worst years on record for the traditional 60/40 portfolio, as equities and bonds declined in tandem6.

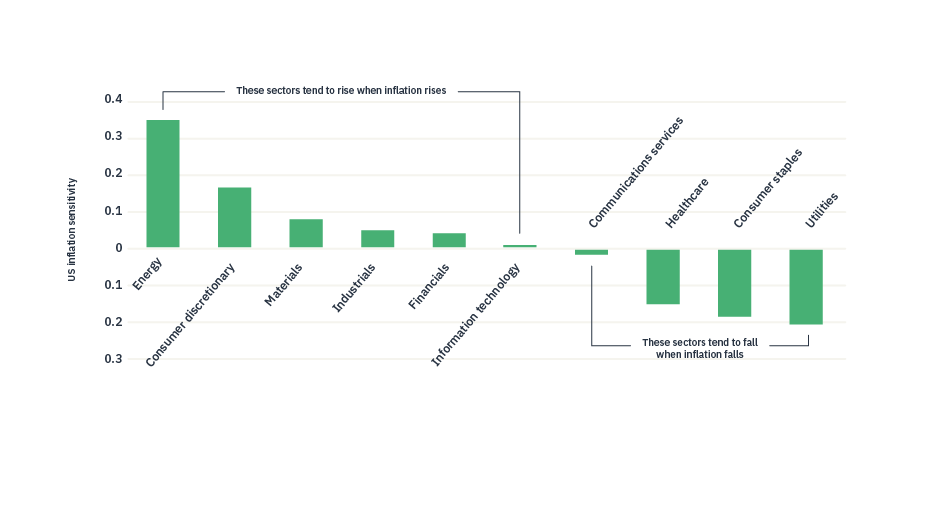

In this scenario, even a diversified portfolio may struggle to counter the eroding effect of inflation, particularly if its underlying investments are unable to pass on its costs to the consumer.

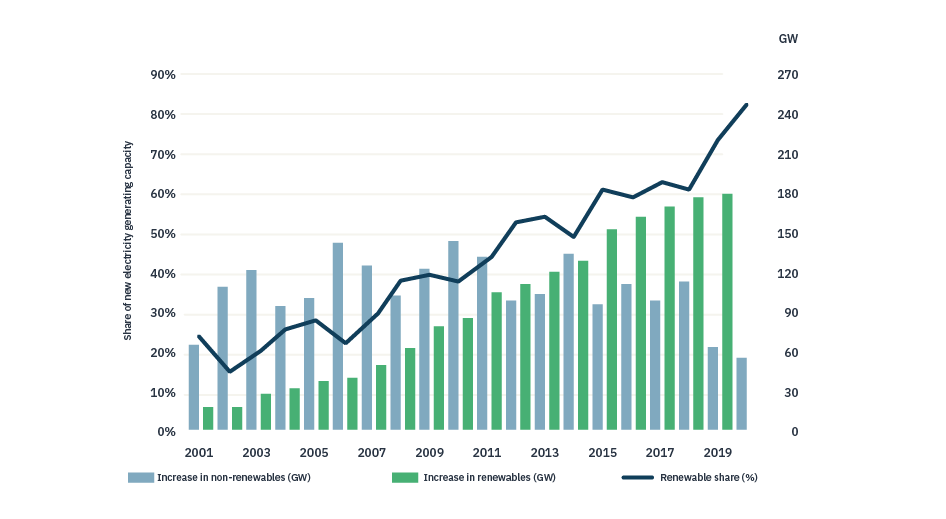

Infrastructure investments tend to behave differently to many of the broader asset classes under these market conditions, correlating more closely with inflation as opposed to fighting against it. In many cases, income generated by real assets, such as property or infrastructure, can be explicitly linked to inflation, meaning that as prices rise, income follows7. This has been compounded by the international move toward renewable energy sources which, given the longer-term nature of these government-backed projects, further bolsters the argument for infrastructure as a hedge against both inflation and volatility. Also of note is the Power Purchase Agreement (PPA) price associated with these projects, which typically moves in lockstep with inflation and thus adds value back into the projects.

As a result, an allocation towards infrastructure may afford an element of inflation linking to a portfolio, while simultaneously providing exposure to longer-term investment opportunities.

Sector sensitivities to changes to US CPI (MSCI US Index, April 2022)

What are the key benefits of investing in green infrastructure?

Over the past decade, there has been a tangible shift towards renewable energy and climate-positive practices. This movement has been underpinned by various commitments made at a national level, through events such as the annual Conference of the Parties (or COP).

Through these pledges, investors are now privy to the mid to long-term outlook of the renewables space, and subsequently the pipeline for infrastructure development required to facilitate them. Unique from private infrastructure projects, much of the developments within the renewables space are backed by national governments, often with built-in timelines. From an investment point of view, this affords a unique level of transparency on the timeline, scale and underlying support for each project.

However, since the advent of Russia’s invasion of Ukraine, development in this area has been expedited as nations move to pivot their energy supply away from traditional materials such as oil and gas. This has been particularly pertinent in Europe, where the ramifications of the Ukrainian war and subsequent squeeze on energy have been felt chiefly.

For example, in December 2022, a €28 billion German renewable energy scheme was greenlit by the EU8, designed to rapidly expand the nation’s use of wind and solar power. This announcement arrived in the wake of significant pressure having been placed on energy prices in the country, owing to its reliance on Russia for gas and oil.

Similar stories of accelerated energy transition can be found across the continent, from the UK’s reported intention to invest heavily in nuclear energy9 to Poland’s ambitions for a wind farm in the Baltic Sea10. Naturally, each of these projects will require a sizeable infrastructure to be developed and ultimately brought to market.

In conclusion, we believe that investing in green infrastructure at this point in the cycle presents a unique opportunity to invest in a structural shift backed by global governments, which may also provide a hedge against both inflation and market volatility.

Renewable share of annual power capacity expansion

How to gain exposure to renewables infrastructure

For investors seeking to gain exposure to the space, there are several options available.

Investors can gain exposure to infrastructure via:

- Listed stocks

- Investment Trusts (with underlying exposure to the sector)

- Open-end private funds (with underlying exposure to the sector)

- Closed-end private funds (with underlying exposure to the sector)

- Fund of funds

There are a multitude of vehicles available, some of which may invest in a broad selection of companies within the space, while others may be more specific, investing in specific sectors or companies within a particular geographic region.

Bluefield, powering a sustainable future.

- VOX EU, 2022

- FT, 2022

- Forbes, 2023

- Bank of England, 2023

- IMF, 2023

- The Motley Fool, 2023

- Nuveen, 2022

- Euronews, 2022

- Gov UK, 2022

- Politico, 2022