Investment markets are evolving – how much do you know about evergreen funds?

Private equity markets are evolving with different structures for investors. But what is drawing investor attention away from traditional fund vehicles? Evergreen funds

What are evergreen funds?

Evergreen funds (also known as “open-ended funds”) are flexible investment vehicles which allow investors to make long-term private market investments which have no fixed end date. For investors seeking greater flexibility and liquidity than traditional funds are able to offer, evergreen alternatives are an increasingly popular solution1.

What are the key differences between evergreen and traditional funds?

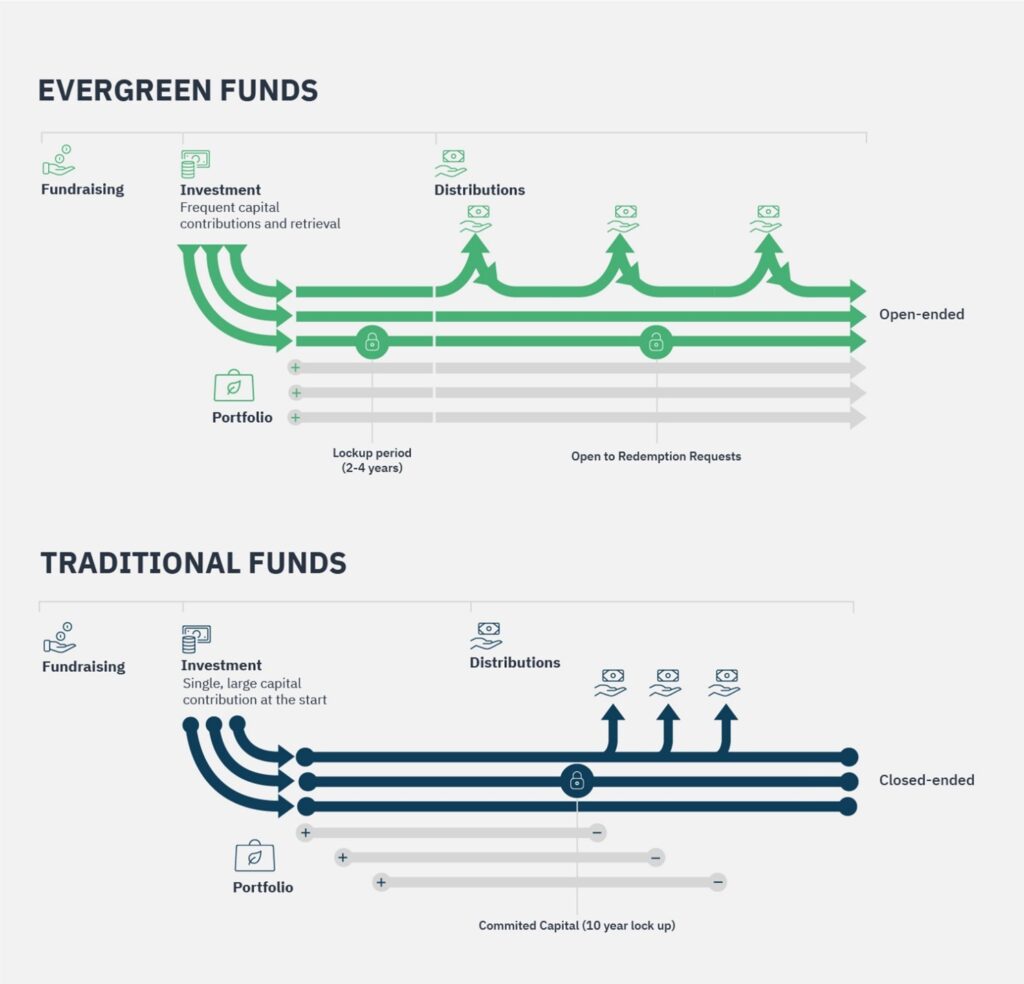

For illustrative purposes only. The difference in the investment processes between evergreen and traditional funds

What are the benefits of evergreen funds?

Higher return potential

When a portfolio investment is realised, the capital can be reinvested into another investment opportunity within the fund rather than being immediately distributed to investors. This reinvestment opportunity allows for continuous compounding of returns and potential growth over time. It also reduces investors’ exposure to reinvestment risk as they do not have to constantly seek new investment opportunities for returned capital.

The ability to reinvest presents further advantages for investors, including simplifying and reducing their administrative burden as they are able to maintain exposure to a diversified portfolio through a single subscription without the need to search and subscribe on a periodic basis.

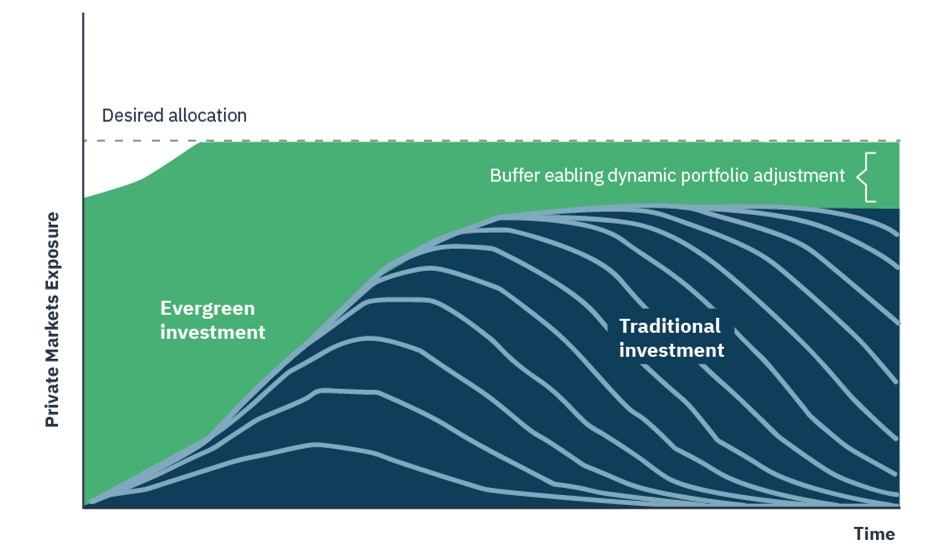

For illustrative purposes only. Comparison of subscription periods between evergreen and traditional funds

Increased flexibility for investors and managers

The structure of evergreen funds provides investors with greater liquidity than equivalent closed-end funds. Investments can be made, or realised, at any time during a fund’s regular redemption windows at its net asset value (NAV) ensuring fair and transparent pricing.

This flexibility can make it easier for investors to adjust their investments up or down to access, redeem or rebalance their capital when needed. Should an investor want to exit the market, they have the option of leaving during a redemption period by selling shares back to the fund or to new investors.

Evergreen funds also empower managers with the flexibility to make more strategic decisions based on the long-term value of assets, market opportunities and macro conditions. This is because, unlike closed-ended vehicles, managers of evergreen funds are not required to sell assets or form new continuation funds simply because the fund is nearing the end of its term. Evergreen funds provide managers the freedom to focus on what is right for all stakeholders, rather than being driven by time constraints.

Greater diversification

Evergreen funds can offer investors diversification advantages by facilitating the spread of their investments across various vintages. Unlike closed-ended funds, evergreen funds do not have vintage risk since they continuously invest over time, providing exposure to different market conditions. This flexibility also enables fund managers to take advantage of opportunities presented by changing market conditions without needing to launch a new vehicle. Given the long-term nature of evergreen funds, they are well suited to buy-and-hold lifetime investments that are less likely to be impacted by short-term market fluctuations.

Inherently long-term

Evergreen funds are able to invest in assets which are long-term in nature and capital can be reinvested to grow assets alongside the fund. This alignment of asset tenure with evergreen funds’ long-term structure allows for an efficient and effective investment strategy.

The long-term nature of this investment style facilitates long-term partnerships with key stakeholders, such as developers and landowners, to build differentiated and reliable deal pipelines. Evergreen funds are able to leverage the strength of these relationships to access otherwise unavailable investment opportunities and gain an edge in sourcing high-quality infrastructure assets.

Potential for lower fees

Investors in evergreen funds only tend to pay fees on capital that has been invested, eliminating the fee and administrative burden on uncommitted capital – common to traditional fund investments. This is particularly advantageous because evergreen funds often deploy capital gradually as the fund expands. Evergreen funds do not experience the ‘J-curve’ phenomenon because capital is put to work from the point of its deployment with no cost to the investor prior to this.

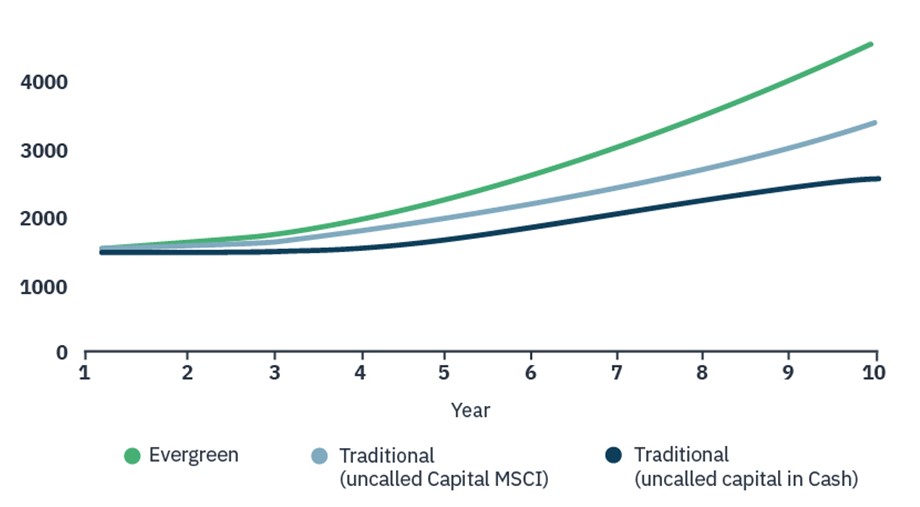

Comparison of returns between evergreen and traditional funds, $Mn

So, why evergreen funds?

Overall, evergreen opportunities provide investors with greater liquidity and dynamic diversification through their long-term nature, which can also transcend market volatility. They provide ample opportunity for well-adjusted potential returns with reduced fee-related downsides, making them compelling alternatives to traditional funds for investors searching for greater flexibility in infrastructure investments.

Bluefield, powering a sustainable future.

Glossary:

- Closed-ended: An investment entity which has a capped and pre-determined term end date

- Diversification: The process of investing into a variety of investments in order to not be overexposed to any one investment, therefore reducing risk

- Dividends: Regular income from investments owned, paid in predetermined intervals

- ‘J-curve’ phenomenon: The typical pattern of negative returns in the early years of a fund’s life due to management fees and initial investment costs before any returns are received

- Liquidity: The ease and speed which an investment is able to be bought and sold

- Lock up: Periods of time in which investors cannot sell their shares

- Net asset value: Related to the net price (total value – liabilities) of an investment vehicle

- Redemption period/window: Predetermined intervals where shares may be sold in order to exit an investment

- Reinvestment risk: The potential that an investor will be unable to reinvest capital at a rate comparable to their current rate of return

- Subscription: The act of an investor purchasing or agreeing to a set number of shares during an offering

- Vintages: Periods when funds are gathering investors to invest for the first time through the fund

DISCLAIMER

This Article is being issued by Bluefield Partners LLP (Bluefield), which is authorised and regulated in the United Kingdom by the Financial Conduct Authority, to provide certain information about Bluefield Partners and its affiliated companies (the Bluefield Group). Bluefield’s registered office address is 40 Queen Anne Street, London, W1G 9EL and its FCA Firm Reference Number is 507508.

Not Advice: The information contained in this Presentation is not intended to be, and should not be construed as, investment, financial, legal, tax or other advice, and is not a recommendation, endorsement or representation as to the suitability of any investment. You should seek independent professional advice before making any investment decision.

No Reliance: This Presentation must not be taken as the basis of any investment decision. Any investment in a fund or investment vehicle involves significant risk, including the risk of loss of capital invested. Any investment decisions must be based upon an investor’s specific financial situation and investment objectives and should be based solely on the information in any final offering documents of the relevant investment.