The central European nation’s clean energy credentials have improved markedly in recent years, making Poland one of the continent’s most promising renewable energy hubs.

Poland has experienced considerable economic and political change in the past 20 years. Historically, the country grappled with issues such as currency risk, political instability, and limited governmental support, particularly with regards to renewable energy infrastructure, all of which had discouraged international investment.

However, Poland’s membership in the European Union and subsequent economic reforms have resulted in a more stable and favourable business environment. This, in turn, has opened the door the door to a greater participation in Europe’s green energy transition.

Here, we consider the evolution of Poland’s renewable energy sector and the events and factors that have led to its current position as one of the continent’s emerging green energy hubs.

Past perceptions: risk factors

Poland was previously viewed as a risky investment destination due to several factors:

- Currency Risk: The volatility of the Polish zloty against major currencies posed a significant risk for international investors.

- Political Risk: Political instability and unpredictability in government policies created an uncertain business environment.

- Low Governmental Backing: There was a lack of substantial support and incentives from the government for renewable energy projects. Furthermore, Poland was less bullish than most of its EU counterparts on establishing strong net zero targets for 2030.

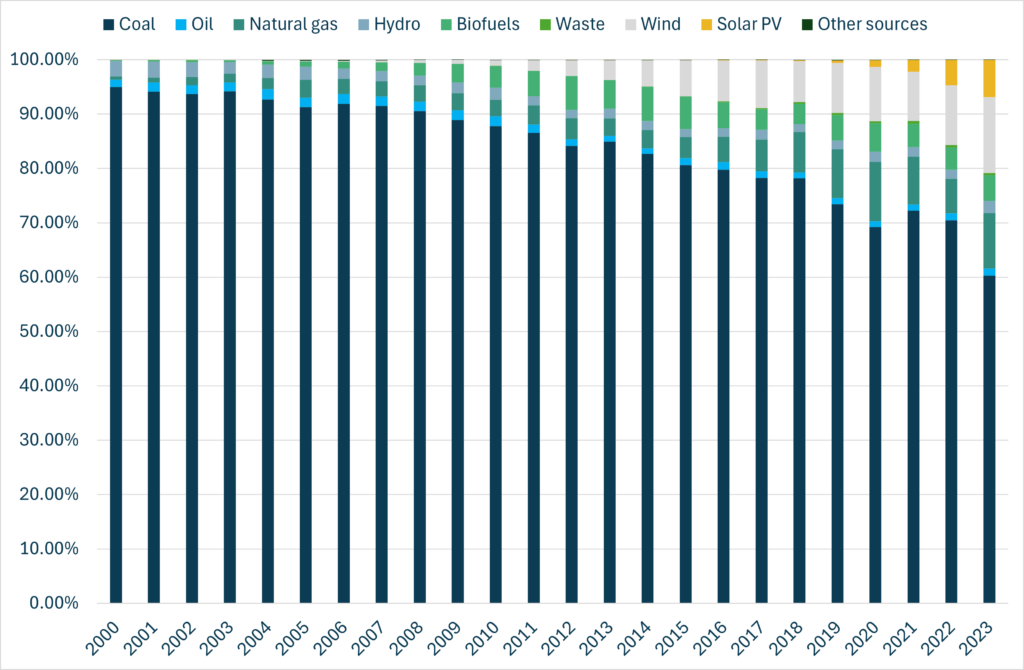

- High Dependency on coal: Over 70% of the energy mix (production) came from coal until 2023. Poland has historically depended highly on coal. As seen below, over 70% of the energy produced came from coal until 2022. As a result, Poland was seen as a less favourable market for renewable energy investors. Secondly, the Polish government had initially opted not to set targets to phase out coal by 2030, unlike some of the other countries in the EU. This showed a lack of direction, and intent, which made investments in Poland sceptical.

Poland’s evolving energy mix

What has changed?

Several positive changes have occurred, making Poland a more attractive destination for renewable energy investments:

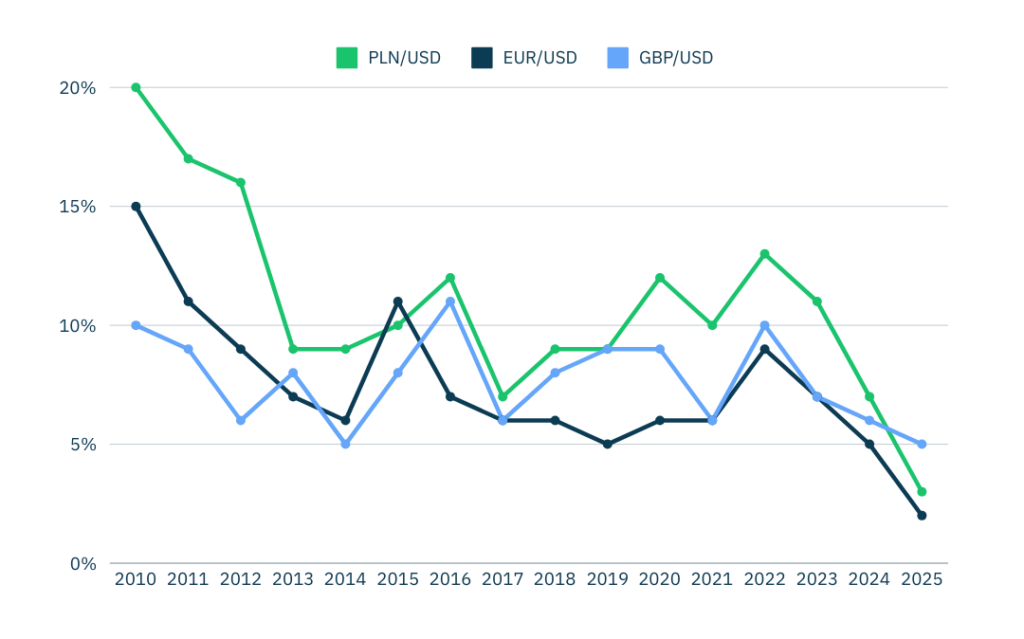

- Stable Currency: The Polish zloty has stabilised, reducing the currency risk for international investors. The country’s economic policies have fostered a more stable financial environment. As seen in the chart below, the volatility of PLN/USD is closing in on the likes of EUR/USD and GBP/USD.

- Stronger Political Backing: The Polish government has shown increasing commitment towards renewable energy, aligning with EU directives and providing better support and incentives for green energy projects. For example, Poland was recently earmarked to receive €13 billion from the ‘FiT for 55’ fund and , also appears to set to be one of the main beneficiaries of the EU’s ‘Social Climate Fund’.

- Interlinked Markets: Poland’s integration into the EU has enhanced its market connectivity, facilitating easier trade and investment processes within the European region. This has been particularly notable since the advent of Russia’s invasion of Ukraine, which has expedited Europe’s shift toward renewables and away from Russian gas.

- Euro Denominated Currency: Although Poland has not adopted the euro, many renewable energy contracts and transactions are euro-denominated, reducing currency risk and attracting more foreign investments.

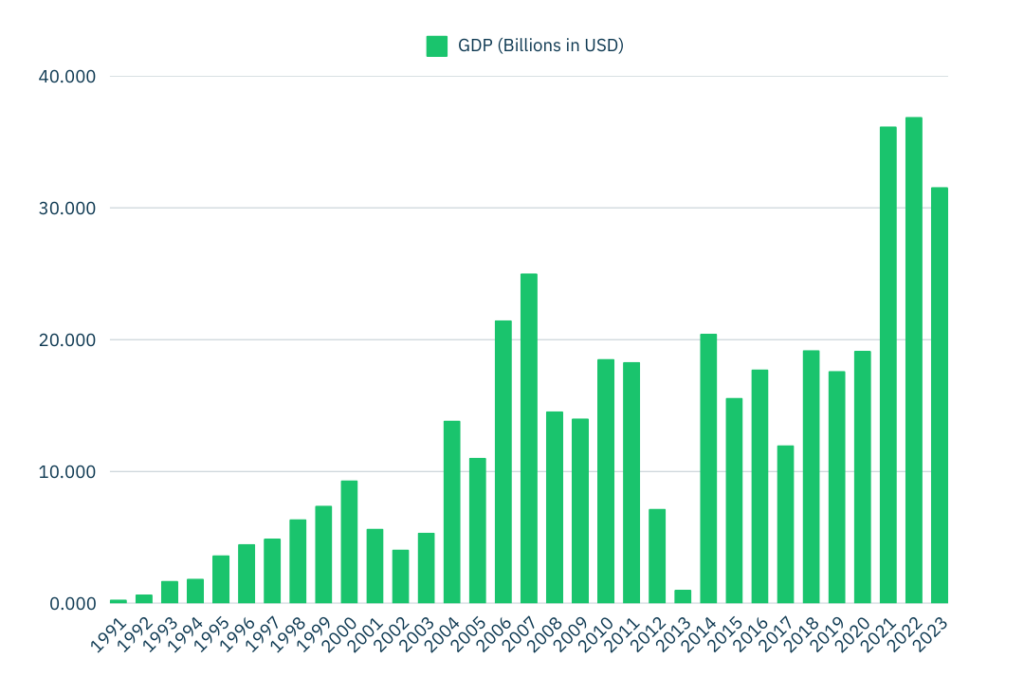

- Strong Foreign Direct Investment (FDI) signals: Since joining the EU in 2004, core macroeconomic metrics such as FDI in Poland peaked significantly but then fell sharply until 2013. In the following years, it hovered around the $20 billion mark, until finally rising post-pandemic.

FDI in Poland

Currency volatility

Where do we see opportunities?

Given these changes, there are several promising opportunities in Poland’s renewable energy sector, particularly in solar PV (photovoltaic), and utility-scale battery energy storage systems (BESS). Poland was a country which focused primarily on onshore wind until the 10H rule was implemented in 2016. Since then, it has been harder for developers to find land that falls within the limits stipulated on which to build onshore wind projects. Furthermore, the Polish government is backing the development of offshore wind in the Baltic Sea.

Solar PV

Poland has seen a surge in solar PV installations, driven by government incentives, national and EU targets, and decreasing costs of solar technology. This is illustrated in the chart below, which highlights Poland’s PV installations across the ten-year period between 2013 and 2023, and in particular, a notable uptick in installations following the pandemic. The country aims to significantly increase its solar capacity in the coming years. Opportunities may exist in:

- Developing large-scale solar farms to meet the growing energy demand.

- Investing in residential and commercial rooftop solar installations.

- Participating in government-backed auctions for renewable energy projects.

- Enhanced efficiency through advancements in modules, coupled with increased affordability, is expected to be beneficial.

- Capacity said to increase from 17.05GW to 29.3GW by 2030.

Growth in Poland’s solar PV capacity from 2013 to 2023

Utility-scale BESS

Energy storage is crucial for balancing supply and demand in the renewable energy sector. Poland’s focus on grid modernisation and energy security has opened considerable opportunities for utility-scale BESS:

- Developing large-scale battery storage projects to support grid stability and reliability.

- Integrating BESS with renewable energy projects to enhance energy storage and dispatch capabilities.

- Leveraging government incentives and support schemes for energy storage technologies.

In conclusion, Poland’s transformation from having been perceived as a risky investment destination to now a promising hub for investments in renewable energy provides valuable insights into the evolving dynamics of the sector. The country’s stable currency, stronger political backing, and interlinked markets present significant opportunities for solar PV and utility-scale BESS.

As the clean energy transition and push toward net zero accelerates, Europe’s emerging markets may look toward Poland as an example of how to navigate a swift rotation away from fossil fuels, through policy alignment and a multi-technology approach.