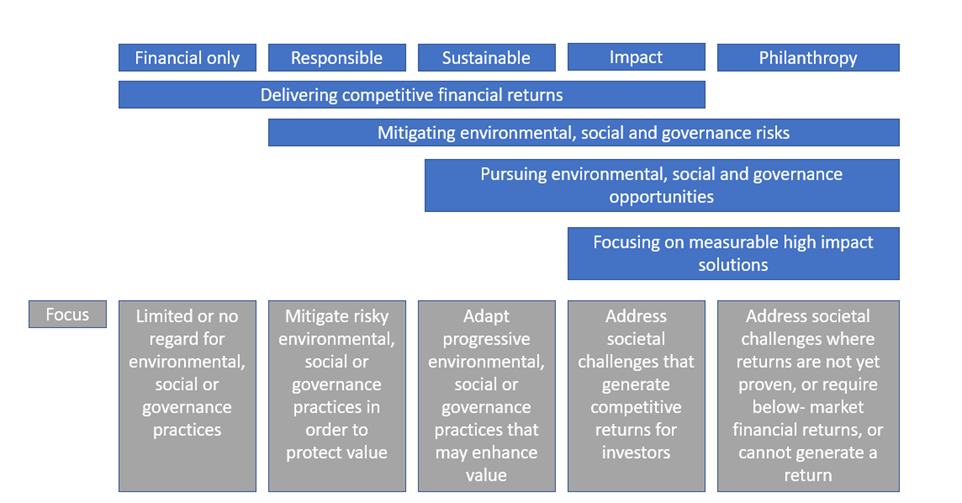

Impact investing sits on the spectrum of investment approaches available to investors – from ‘traditional’ financial-only investing through to philanthropic investing.

The graphic below, adapted from the Organisation for Economic Co-operation and Development (OECD), summarises the focus of investors within the different classifications of responsible investing.

The Global Impact Investing Network (GIIN) define impact investing as “investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.1”

The impact investing market seeks to address some of the world’s most critical challenges, including:

- Sustainable agriculture

- Renewable energy

- Conservation

- Microfinance

- Affordable, accessible services (including housing, healthcare, education and energy)2

The global impact investing market was valued at $3 trillion in 2023 and is projected to reach $7.78 trillion by 20333.

Returns in impact investing – is there a difference to traditional investments?

One of the common misperceptions about impact investing is that it requires a sacrifice on returns. However, studies have shown that impact investments are competitive with traditional investments in terms of financial return. A study by Bain & Company found that ‘impact investments have the potential to generate higher risk-adjusted returns than traditional investments’4.

Further research has found similar results:

- A meta-study by Friede & Busch which assessed the relationship between environmental, social and governance (ESG) factors and corporate financial performance found that over 90% of the more than 2,200 pieces of academic work surveyed showed that ESG factors do not harm financial returns5.

- Research from JP Morgan in 2020 found that impact investments outperformed traditional investments6.

- A 2020 survey by the Global Impact Investing Network (GIIN), found that 55% of impact investment opportunities resulted in returns that were market rate or higher7.

- Research by Cary Krosinsky and Nick Robins in their book Sustainable Investing: The Art of Long Term Performance has established that investment strategies based on seeking out sustainable companies see greater outperformance compared to negative screening or passive instruments such as the MSCI World or S&P 500 indices8.

Impact investments – where is the opportunity?

Investments aimed at addressing societal challenges, such as energy supplies, are inherently long-term in nature. They therefore generally offer investors an overall less volatile and smoother rate of return, which can be advantageous depending on an investors’ needs. They also tend to show more positive results over the long-term as investors are less likely to make emotional decisions in times of market volatility which could lead to them losing money over the long-term9.

Whilst some impact investment opportunities can see short term societal benefits and financial returns, they also contribute to the bigger picture – impact investments tend to create jobs, which contributes to overall economic growth, which in turn benefits investors.

Impact investments also give investors access to some of the fastest growing sectors which are giving rise to new opportunities. The renewable energy space is a good example of this – IRENA (International Renewable Energy Agency) estimate that nearly £4 trillion in investment is needed each year to achieve the Paris Agreement goal of limiting global warming to 1.5 degrees Celsius above pre-industrial levels. 2023 saw global investment of just over £1 trillion, so there is clearly enormous potential for opportunities in this space10.

What are the challenges of impact investing?

One of the key challenges traditionally faced by impact investors has been sourcing opportunities that offer more reliable returns – this has been the case particularly in sectors with rapidly developing or unproven technologies. Early investors in the renewables space took on significantly more risk than today’s investors as the technology required was still developing, and often very expensive, and this is certainly still the case in some sub-sectors, such as hydrogen. However, in sub-sectors, such as wind and solar energy, the technology is now well established, and the associated costs have fallen significantly11, making this arguably one of the more dependable impact investing segments available to investors.

What does this all mean?

Overall, despite common misconceptions, there is little evidence to suggest that impact investments offer lower returns than traditional investments12. There is plenty of evidence, from the likes of Bank of America and JP Morgan, to show that actively choosing sustainable investments can boost returns over the long term1314.

[1] The GINN (no date) What you need to know about impact investing. Available at: https://thegiin.org/impact-investing/need-to-know/#what-is-impact-investing

[2] The GINN )no date) What you need to know about impact investing. Available at: https://thegiin.org/impact-investing/need-to-know/#what-is-impact-investing

[3] The Brainy Insights – Impact Investing Market Size Worth $7.78 Trillion by 2033; The Global Pursuit of Sustainable Development to Propel Growth Sizing the impact investing market 2022. Available at: https://finance.yahoo.com/news/impact-investing-market-size-worth-230000781.html?

[4] Trahant, G. (no date) 56 social impact investing ventures changing the world through finance. Available at: https://causeartist.com/changing-the-world-through-social-impact-investing/

[5] Smith, D. (2022) Impact investments: Better returns? But fewer opportunities Available at: https://www.growthcapitalventures.co.uk/insights/blog/if-impact-investments-can-produce-better-than-average-returns-why-arent-there-more-impact-driven-opportunities

[6] Trahant, G. (no date) 56 social impact investing ventures changing the world through finance. Available at: https://causeartist.com/changing-the-world-through-social-impact-investing/

[7] The GINN )no date) What you need to know about impact investing. Available at: https://thegiin.org/impact-investing/need-to-know/#what-is-impact-investing

[8] Rabo, O. (2021) Is impact investing profitable? Available at: https://www.coolerfuture.com/blog/is-impact-investing-profitable#:~:text=Debunking%20the%20fears%20(and%20traditional%20risk%20%26%20return%20models)

[9] Wealth Watch Advisors LLC (2020) Quantitative Analysis of Investor Behaviour Available at: https://wealthwatchadvisors.com/wp-content/uploads/2020/03/QAIB_PremiumEdition2020_WWA.pdf

[10] IRENA (2023) Investment Needs of USD 35 trillion by 2023 for Successful Energy TransitionAvailable at: https://www.irena.org/News/pressreleases/2023/Mar/Investment-Needs-of-USD-35-trillion-by-2030-for-Successful-Energy-Transition#:~:text=Power%20generation%20needs%20to%20more%20than%20triple%20by%202050&text=Although%20global%20investment%20in%20energy,the%201.5%C2%B0C%20pathway.

[11] Bloomberg New Energy Finance, 1H 2022 LCOE Update report Available at: https://about.bnef.com/new-energy-outlook/

[12] CNote (2020) Does Impact Investing Equate to Lower Returns? Available at: https://www.mycnote.com/blog/does-impact-investing-have-lower-returns/

[13] Trahant, G. (no date) 56 social impact investing ventures changing the world through finance. Available at: https://causeartist.com/changing-the-world-through-social-impact-investing/

[14] Rabo, O. (2021) Is impact investing profitable? Available at: https://www.coolerfuture.com/blog/is-impact-investing-profitable#:~:text=Debunking%20the%20fears%20(and%20traditional%20risk%20%26%20return%20models)